Artificial Intelligence (AI) burst onto the scene earlier this year with the introduction of the ChatGPT chatbot, and the prospects for AI are as exciting as they are dire. Writing and programming tasks, to name just two examples, can be greatly streamlined with the aid of intelligent chatbots.

The financial markets quickly took note, and the potential for enhancing productivity and reducing costs spurred a rally in the S&P 500 Index. More specifically, seven mega-cap tech companies, often referred to as the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla), have seen most of the benefits due to their exposure to the AI sector, lifting the rest of the index along with them. So far this year, the S&P 500 has risen almost 16%, but without those seven, the increase is just about 4%.

This has led investors to wonder: Can this new technology provide immediate earnings benefits, or is it simply fueling another tech stock bubble?

Why is AI gaining market traction now?

AI has captured people’s imaginations for decades – whether that meant talking to computers in movie plots or wishing the average menial task would disappear. The difference now is that we can truly see its impact. Early adaptations of artificial intelligence have been around for a while (think “smart” devices or facial recognition), but the recent introduction of large language models (LLMs, like ChatGPT) has made the technology more accessible and user-friendly. LLMs are designed to mimic human language, allowing for plain English or other languages to be used as inputs for programming. This development has caught the attention of businesses and investors who recognize the potential of AI as a productivity-enhancing tool that can be integrated into existing workflows without the need for extensive retraining. At the same time, improvements in computing power have also allowed researchers to train models with more parameters resulting in better performance.

Is there a bubble in AI stocks?

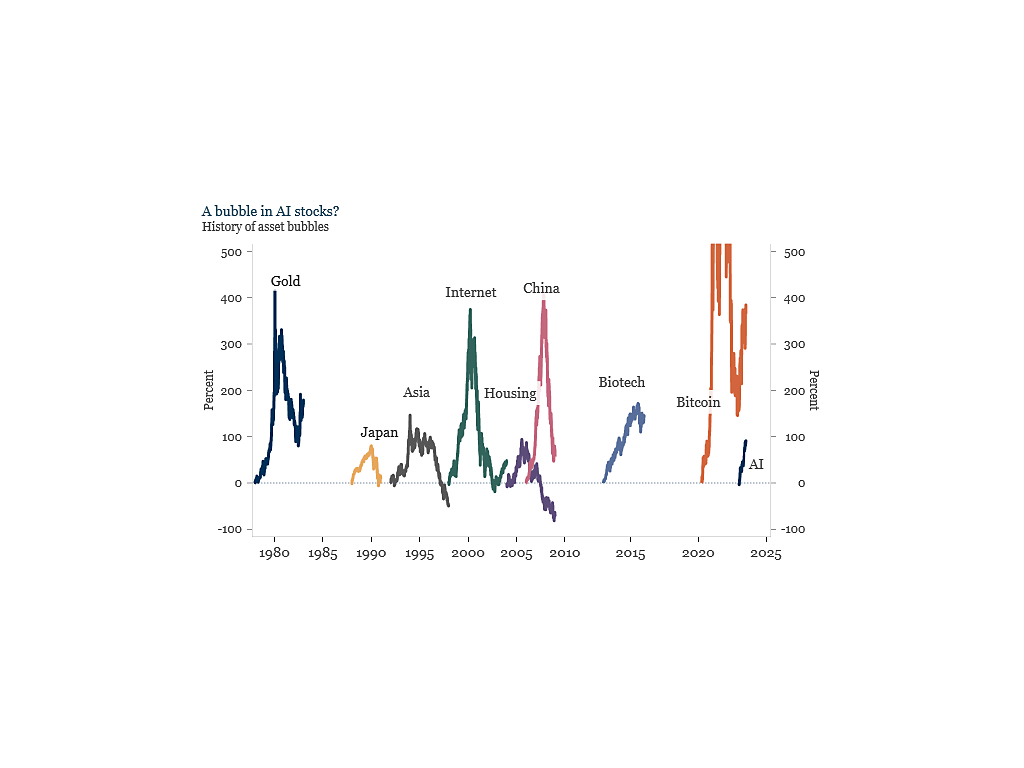

Potentially, but that doesn’t mean it’s about to pop. The surge in the value of stocks related to the expected benefits of artificial intelligence has caught even the most bullish investors off guard. The rapid growth and fervor surrounding AI investments are drawing comparisons to the dot-com bubble of the late 1990s.

However, there are a couple of things to keep in mind when drawing that comparison. First, the dot-com bubble “popped” as the Fed began hiking interest rates and global economic growth slowed. This time gains for AI-relevant companies have been surging in spite of the Fed’s recent hiking cycle.

Second, valuation is not a particularly useful investment timing tool. Certainly, it has been difficult for companies to grow into bubble-like valuations in previous cycles, suggesting that those valuations would need to reset at some point. And, while AI has the potential to generate significant productivity gains, the exact timing of such advancements remains uncertain, leading investors to struggle in determining the appropriate rate at which future earnings should be discounted. However, those concerns do little to tell investors when lofty valuations might reset, especially when “fair value” around a new technology is so uncertain.

Finally, the current rally in the so-called “Magnificent 7” stocks undeniably resembles a bubble. Nevertheless, as depicted below, when compared to previous historical bubbles, there is still room to grow.

Sources: New York Life Investments Multi-Asset Solutions, London Bullion Market Association (LBMA), Nikkei, The Stock Exchange of Thailand (SET), Nasdaq, S&P Global, Shanghai Stock Exchange, Macrobond, 7/3/2023. Gold is represented by the daily price provided by the LMBA. Japan is represented by the Nikkei index. Asia is represented by the SET index. Internet is represented by the Nasdaq index. Housing is represented by S&P 500 Homebuilding index, China is represented by the Shanghai Stock Exchange index, Biotech is represented by the S&P 500 Biotechnology index. AI is represented by an equal-weighted index of the share prices of the following companies: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla. Past performance is not a guarantee of future results. It is not possible to invest in an index. Index definitions can be found the end of this piece.

Will AI drive productivity gains?

AI has the potential to drive significant productivity gains. The ability of AI systems to automate tasks, analyze large amounts of data, and make intelligent decisions has the capacity to revolutionize industries across the board. However, the extent and timing of these gains remain uncertain. While AI has already shown promising results in various applications like customer support, the full realization of its impact will depend on continued advancements in technology, data availability, and integration into existing workflows.

With AI tools, like any tool, the quality of the output depends on the quality of the input. AI outputs will only be as good as the data organized, the questions asked, the bias and perspectives taught, and the analytic skill to interpret. These constraints may prove temporary – it is typical for new technology to require learning – but cast more dispersion on potential economic outcomes.

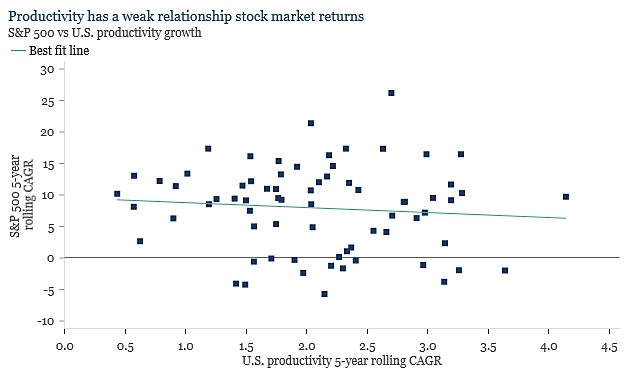

Will AI productivity gains translate into stock market performance?

Not necessarily. Amidst the excitement surrounding AI, mega-cap tech companies have seen most of the gains due to their exposure to the AI sector. But for the broader S&P 500, it’s still unclear how and when these companies will translate technology improvements into top and bottom-line growth; and this may not be fully priced by investors in the near term. However, historical data suggests productivity gains have little effect on long term stock market returns.

This relationship likely emphasizes that new technology can create disparities between companies who successfully adapt and those who struggle to keep up – the winners and losers. Consider the digital photography revolution as an example. Film-based photography companies who embraced this new technology and broke into the digital camera space succeeded. Those who were reluctant fell behind.

Sources: New York Life Investments Multi-Asset Solutions, U.S. Bureau of Labor Statistics (BLS), S&P Global, Macrobond, 1952 – 2022. CAGR is the abbreviation for compound annual growth rate which measures an investment's annual growth rate over a period of time. The best fit line is determined by minimizing the sum of squared distances between the points and the line. Past performance is not a guarantee of future results. It is not possible to invest in an index. Index definitions can be found the end of this piece.

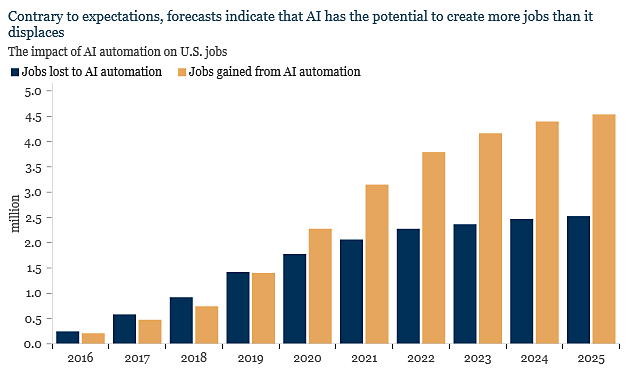

How will AI impact the labor market?

As is the case with company performance, there will likely be some winners and some losers among workers as AI proliferates. Many economists are attempting to forecast the labor disruption artificial intelligence will make, though as alluded to above, it is exceedingly difficult to determine the exact timing and extent of this disruption. Early estimates suggest that approximately half to two-thirds of U.S. occupations may be affected to some degree by AI-driven automation. For most jobs, AI is expected to create opportunities for workers by freeing up labor capacity for more productive activities. Certain roles, particularly in administrative and legal support, may be more susceptible to AI replacement. Nevertheless, it is important to remember that throughout history, technological advancements have reshaped the labor landscape, giving rise to new jobs that didn't exist before. Looking ahead, there will undoubtedly be a multitude of jobs in the future that have yet to emerge today.

Take the introduction of the ATM (automated teller machine) in the 1960s as an example. The ATM revolutionized the banking industry by replacing many traditional bank teller jobs. Today, advancements in technology, such as online banking and robo-advisors, further reduce the need for human tellers in banks. This shift towards automation and digitalization in the banking sector has significantly increased the speed and efficiency of banking operations, resulting in greater productivity gains – but perhaps at the expense of certain jobs.

Source: New York Life Investments Multi-Asset Solutions, Gartner, Macrobond, 6/7/23. Gartner forecasts as of 2018.

What are the policy implications of AI adoption?

Policymakers are still figuring it out. Congressional and local leaders have started holding hearings with tech companies’ CEOs to address the regulation of artificial intelligence, though policy development on the issue is still in the early stages.

One potential policy response to the economic and social impact of the displacement of workers due to AI adoption is a higher corporate tax rate. Supporters argue that such a tax could help mitigate job displacement by slowing down AI adoption, giving workers more time to adapt and find new employment. Additionally, the revenue generated from AI taxes could fund social programs like universal basic income or job retraining initiatives to support those affected by AI. Implementing a tax structure could also incentivize responsible AI development and prevent its overuse in situations where human labor is more suitable. Lastly, the revenue from AI taxes could contribute to the infrastructure development necessary to sustain the technology (i.e., digital infrastructure, energy, and other relevant inputs).

How can investors think about AI investment today?

- Act with caution before jumping in. The rally in mega-cap has certainly been impressive but we think that space is relatively expensive at its current high multiples.

- Unseen beneficiaries: With most of the market fixed on mega-cap tech, investors can use this opportunity to consider managers who focus on smaller companies. This area of the market is often overlooked. Small and medium-sized profitable growth companies, for instance, may (or have offered) offer exposure to AI development at attractive valuations.

- Thematic satellite exposure: For investors looking for AI exposure, consider carving out a satellite in the portfolio (for example, 5%-10% of the equity allocation) and investing in thematic exposure to AI or innovation funds. Prioritizing risk management and asset allocation, especially at this stage of the business cycle, is crucial.

- Infrastructure: It's not just computer chip manufacturers that could benefit from AI investment, but also companies involved in building the digital infrastructure.

- Thinking outside the box: Investors could also look beyond traditional technology sectors and consider industries like agriculture, where many companies are embracing AI to improve crop yields and profit margins.

Definitions

The Nasdaq Index is a composite stock market index that includes the stocks listed on the Nasdaq stock exchange.

The Nikkei Index is a stock market index for the Tokyo Stock Exchange.

The S&P 500 is an unmanaged index that is widely regarded as the standard for measuring large-cap U.S. stock market performance.

The S&P 500 Homebuilders Index comprises stocks from the S&P 500 that are classified in the GICS Homebuilders sub-industry.

The S&P 500 Biotechnology Index comprises stocks from the S&P 500 that are classified in the GICS Biotechnology sub-industry.

The SET Index is a Thai composite stock market index calculated by the prices of all common stocks on the main board of the Stock Exchange of Thailand (SET).

The Shanghai Stock Exchange Index is a stock market index of all stocks that are traded at the Shanghai Stock Exchange.

This material represents an assessment of the market environment as at a specific date; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

“New York Life Investments” is both a service mark, and the common trade name, of certain investment advisors affiliated with New York Life Insurance Company. Securities are managed by New York Life Investment Management LLC and distributed by NYLIFE Distributors LLC, 30 Hudson Street, Jersey City, NJ 07302.

SMRU: 5788869

This blog is part of our 2023 Midyear Multi-Asset Outlook. Click here for the full Outlook.

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.