THE MINDS BEHIND MUNIS

The MacKay Municipal Managers Difference

At MacKay Municipal Managers, deep credit research, relative value analysis, and relentless attention to liquidity form the cornerstone of a time-tested investment process. These principles help the team cut through the noise of a fragmented market and identify opportunity with precision and purpose. This disciplined, research-driven approach powers a range of highly regarded municipal solutions across ETFs, mutual funds, interval funds, private vehicles, and SMAs.

$82B Municipal AUM

as of 9/30/25

Nearly 30

Dedicated Employees

20 Years of Experience

on Average

MUNI TOOLS & RESOURCES

Municipal Bond Asset Allocation Guides

Discover MacKay Municipal Managers’ municipal bond allocation portfolios designed for those seeking to construct blended exposures.

For Advisors Only

MacKay Municipal Managers provides its municipal bond asset allocation portfolios for investors seeking to construct blended exposures. For Financial Advisors looking to build their clients’ portfolios, download our Municipal Bond Asset Allocation Guide.

Investors, please inquire about our guide with your financial advisor.

MUNI TOOLS & RESOURCES

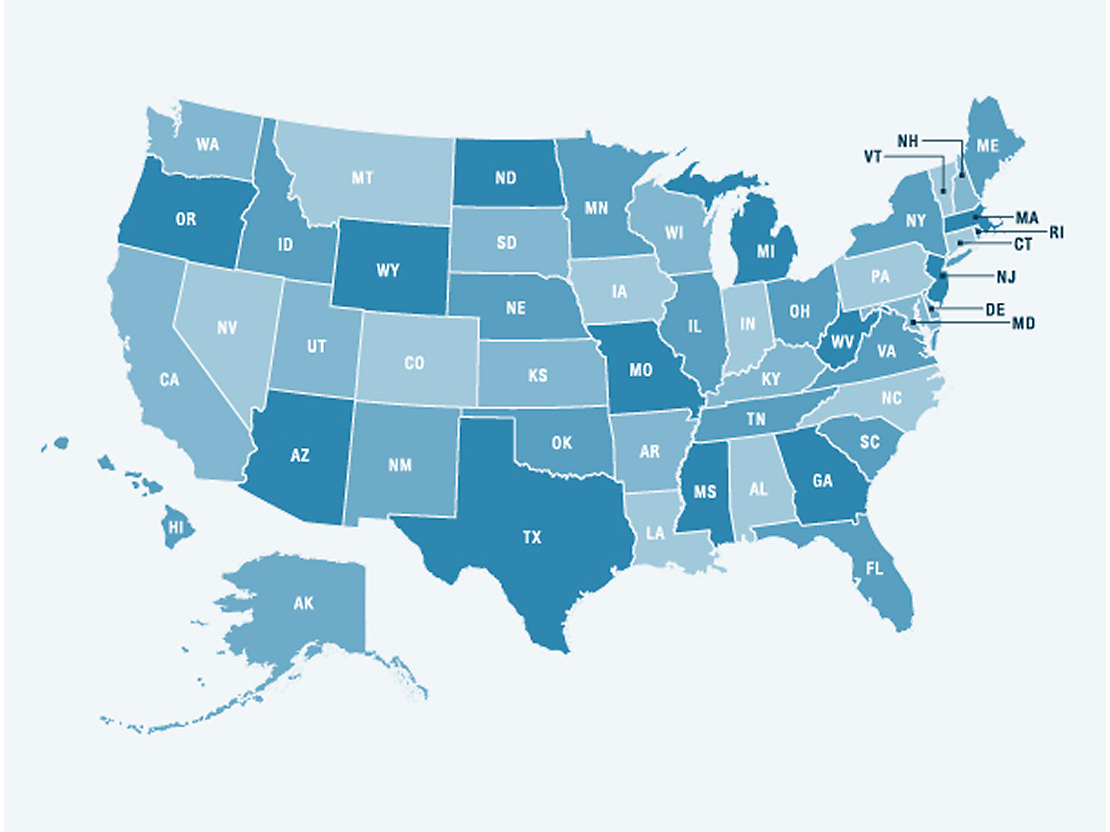

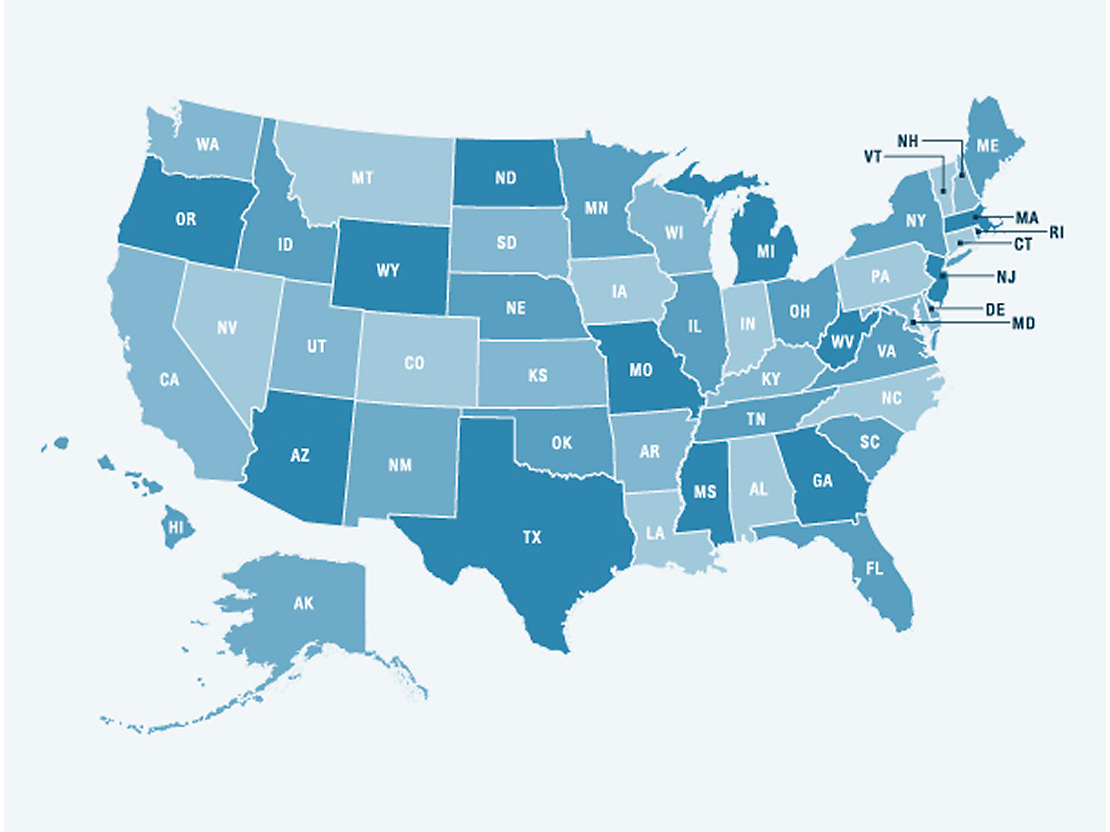

Muni 360 State Profiles Map:

State by State Breakdown

Use this interactive tool for key statistics that summarize the municipal profile for each state.

MUNI TOOLS & RESOURCES

Muni 360 State Profiles Map: State by State Breakdown

Use this interactive tool for key statistics that summarize the municipal profile for each state.

MUNI SOLUTIONS

Featured Municipal Bond Solutions

Click on the Fund Name, which includes the prospectus, investment objectives, performance, risk, and other essential information. Returns represent past performance, which is no guarantee of future results. Current performance may be lower or higher. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Visit www.newyorklifeinvestments.com for the most recent month-end performance.

WEBINAR • JANUARY 16, 2026

Top 5 Muni Market Insights for 2026: Discipline Drives Differentiated Results

Join MacKay Municipal Managers™ for an in-depth discussion of the “Top 5 Muni Market Insights for 2026” and how evolving technicals, credit dispersion, and curve dynamics may reshape portfolio outcomes.

WEBINAR • JANUARY 16, 2026 1PM ET

Top 5 Muni Market Insights for 2026: Discipline Drives Differentiated Results

Join MacKay Municipal Managers™ for an in-depth discussion of the “Top 5 Muni Market Insights for 2026” and how evolving technicals, credit dispersion, and curve dynamics may reshape portfolio outcomes.

By subscribing, you are consenting to receive personalized online advertisements from New York Life Investments. By unsubscribing, you will no longer receive personalized online advertisements from New York Life Investments.

By subscribing, you are consenting to receive personalized online advertisements from New York Life Investments. By unsubscribing, you will no longer receive personalized online advertisements from New York Life Investments.

CONTACT US

Have a Question?

Contact us to find out how our muni solutions fit into your portfolio and learn more about our broad range of investment products and solutions.

About MacKay Municipal Managers™

MacKay Municipal Managers™ is a recognized leader in active municipal bond investing and is entrusted with $XX billion in assets under management, as of December 31, 2025. The team manages a suite of highly rated municipal bond solutions available in multiple vehicles. MacKay Municipal Managers™ is a fundamental relative-value bond manager that combines a top-down approach with bottom-up, credit research. Our investment philosophy is centered on the belief that strong long-term performance can be achieved with a relative value, research driven approach in a highly fragmented, inefficient municipal bond market.

About MacKay Shields LLC

MacKay Shields LLC (together with its subsidiaries, "MacKay")*, a New York Life Investments company, is a global asset management firm with $158B billion in assets under management** as of September 30, 2025. MacKay manages fixed income strategies for high-net worth individuals and institutional clients through separately managed accounts and collective investment vehicles including private funds, collective investment trusts, UCITS, ETFs, closed end funds and mutual funds. MacKay provides investors with specialty fixed income expertise across global fixed income markets including municipal bonds, high yield bonds, investment grade bonds, structured credit, and emerging markets debt. The MacKay Shields client experience provides investors direct access to senior investment professionals. For more information, please visit www.mackayshields.com or follow us on Twitter or LinkedIn.

* MacKay Shields is a wholly owned subsidiary of New York Life Investment Management Holdings LLC, which is wholly owned by New York Life Insurance Company. "New York Life Investments" is both a service mark, and the common trade name of certain investment advisers affiliated with New York Life Insurance Company.

** Assets under management (AUM) as of December 31, 2025 represents assets managed by MacKay Shields LLC and its subsidiaries but excludes certain accounts and other assets over which MacKay Shields continues to exercise discretionary authority to liquidate but which are no longer actively managed.

About Risk

Municipal Bond risks include the ability of the issuer to repay the obligation, the relative lack of information about certain issuers, and the possibility of future tax and legislative changes, which could affect the market for and value of municipal securities. Bonds face interest-rate and credit risk. When interest rates rise, bond values can decrease, and there's a risk that the issuer may not pay interest or principal on time.

High-yield or “junk bonds” are speculative due to their higher risk of loss compared to higher-quality securities. Municipal bonds issued by or on behalf of states or municipalities may experience increased volatility as a result of adverse fiscal, economic, or political developments affecting those issuers.