In early 2023, the share price collapse of Adani Group following a report by the short-seller Hindenburg Group, threatened to destabilize the financial underpinnings of India’s stock market. As the story unfolded, there was palpable fear that the development model of allowing large conglomerates to drive growth in the country had been dealt a fatal blow.

Indeed, the flaws identified by Hindenburg — opaque structures, cross shareholding and bookkeeping puffery — are present in other Indian companies, albeit on a far smaller scale. However, what might have been a huge crisis of confidence in Indian capitalism turned into a watershed moment that underscored both the resilience of corporate India and the valuations of key companies.

From the Raj to free markets

Shortly after India gained independence from Great Britain in 1947, a system of strict government control of the economy was introduced and kept in operation until the mid-1990s. Often referred to derogatorily as the ‘License Raj’, the system had many parallels with Soviet economic management.

Today, the aftereffects of centralized planning remain visible in poor resource allocation. Another consequence is that India has yet to embrace global financial markets – the Federal government, for example, has never issued sovereign debt in a foreign currency.

Conglomerate-led development

Since winning the presidency in 2014, the Modi government has embraced privatization and liberalization. His ‘Make in India’ initiative also favored national champions, making domestic conglomerates particularly well positioned.

Post-deregulation, the conglomerate growth model has helped to offset structural weaknesses in some sectors. It has also led to streamlined decision making, superior financial management and access to bigger pools of capital.

India’s potential

Over time India could become a third superpower, ushering in a truly multi-polar era. The sub-continent’s vast and still growing population, its significant portion of English speakers and huge numbers of well educated, highly skilled workers - combined with India’s famous entrepreneurial spirit – offer the potential to create a political and economic force to rival China and the US.

Indian output per capita ($2,500) is just half of Indonesia’s, and a fraction of China and Malaysia’s ($12,000). We believe this gap will narrow over the next decade, pushed by the Modi government’s structural reform agenda of de-regulation and market liberalization.

Growth drivers

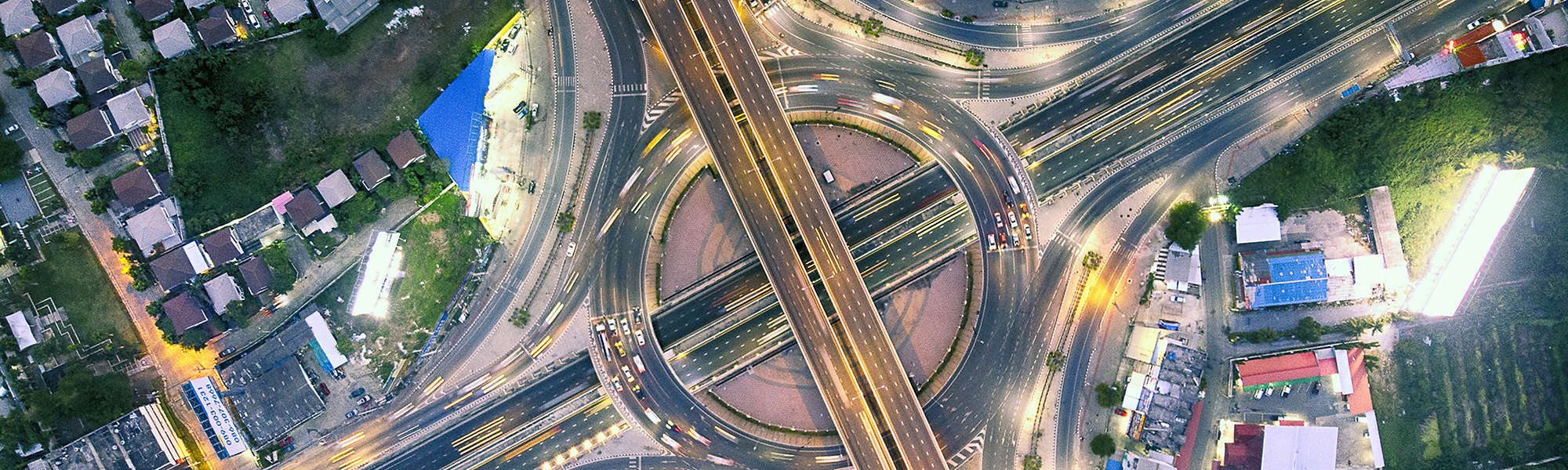

Some 900 million Indians – about 65% of the population – live in rural areas. Yet even if migration is less pronounced than in China’s urbanization-driven growth trajectory, it is likely to turbocharge India’s expansion for years and deliver valuable productivity gains.

Green energy offers a second big growth driver. A plan to de-fossilize electricity production and political backing for green energy providers has created a significant renewable energy sector.

India is now the 3rd largest market for green energy with renewables providing just over one quarter of total installed capacity. The predictable revenue streams of renewable power have attracted global fixed income investors and resulted in the emergence of a large investible universe of green energy bonds.

Challenges to investing

Investing in India presents unique challenges and opportunities. The lack of a US dollar denominated sovereign bond curve makes it harder for investors to price, trade and compare corporate bonds. Yet it also rewards skilled investors with a deep understanding of policy making and sovereign risk in the absence of an easily observable yield curve.

Tightly regulated capital flows and administrative burdens are other hurdles. This makes accessing the domestic market for foreign investors much more difficult than elsewhere in Asia.

Still, we expect Indian bond markets to expand substantially in tandem with GDP growth, meaning many more securities will be issued. Furthermore, as growth drivers broaden out, the capital needs of the Indian economic development story should offer many additional investment opportunities.

Governance and risk

The furor around the Adani Group displays how understanding corporate governance practices and potential shortfalls is crucial to understanding credit risk in India. Among conglomerates, disclosures, ESG reporting and investor engagement lag other public companies.

Understanding top-down contagion risk that might arise from a holding company is thus vital. The market reaction to the Hindenburg report – despite the stand-alone soundness of the ports and retail electricity business within the Adani Group – highlighted this.

Conclusion

Liberalization has put the conglomerate business model at higher risk, even though superior access to capital and political connections remain major advantages. Security selection is thus vital as is understanding how sovereign risk can play out. A good illustration of this is how the financial health of state-owned electricity distributors has often determined investment outcomes in the fast-growing renewables sector.

We believe that India, while already a leader in services, can become a much more significant source of global aggregate demand for goods, especially if Indian firms become more deeply integrated into global supply chains. How to benefit from this megatrend will remain one of the central investment considerations for many years to come.

NOTE TO EUROPEAN INVESTORS

This document is intended for the use of professional and qualifying investors (as defined in the Alternative Investment Fund Manager’s Directive) only. Where applicable, this document has been issued by MacKay Shields Europe Investment Management Limited, Hamilton House, 28 Fitzwilliam Place, Dublin 2 Ireland, which is authorized and regulated by the Central Bank of Ireland.

IMPORTANT DISCLOSURE

Availability of this document and products and services provided by MacKay Shields LLC may be limited by applicable laws and regulations in certain jurisdictions and this document is provided only for persons to whom this document and the products and services of MacKay Shields LLC may otherwise lawfully be issued or made available. None of the products and services provided by MacKay Shields LLC are offered to any person in any jurisdiction where such offering would be contrary to local law or regulation. This document is provided for information purposes only. It does not constitute investment or tax advice and should not be construed as an offer to buy securities. The contents of this document have not been reviewed by any regulatory authority in any jurisdiction.

This material contains the opinions of certain professionals at MacKay Shields but not necessarily those of MacKay Shields LLC. The opinions expressed herein are subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates, and opinions contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Any forward-looking statements speak only as of the date they are made and MacKay Shields assumes no duty and does not undertake to update forward-looking statements. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of MacKay Shields LLC. ©2023, MacKay Shields LLC. All Rights Reserved.

USE OF ISSUER NAMES

Issuer names used herein are provided as examples for educational and illustrative purposes only and are not intended, nor should they be construed as, recommendations to buy or sell any individual security.

Information included herein should not be considered predicative of future transactions or commitments made by MacKay Shields LLC nor as an indication of current or future profitability. There is no assurance investment objectives will be met.

Past performance is not indicative of future results.

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.