How a U.S. Election Could Impact Your Investment Goals

Little savings, lower yields, longer lives and more retirees. More than ever before, there is a myriad of potential obstacles when seeking to obtain a secure financial retirement. While historical performance helps us understand the big picture, returns during and after the 2020 election could vary widely. Instead of trying to time the market, Americans can keep a long-term focus and, if suitable, consider investing more heavily in equities--a powerful option in the current low rate environment.

Understanding the impact of longevity on investor portfolio

Longevity can be a tricky concept for investors to tackle. New York Life Investments can help with strategies and solutions with a long-term focus.

Will you outlive your savings?

By allocating more of their portfolio to equities, investors may increase the odds of retiring whenever they want with funds that will last their entire lifetime.

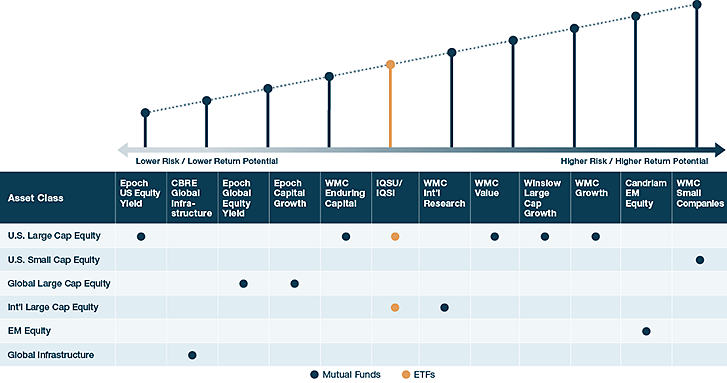

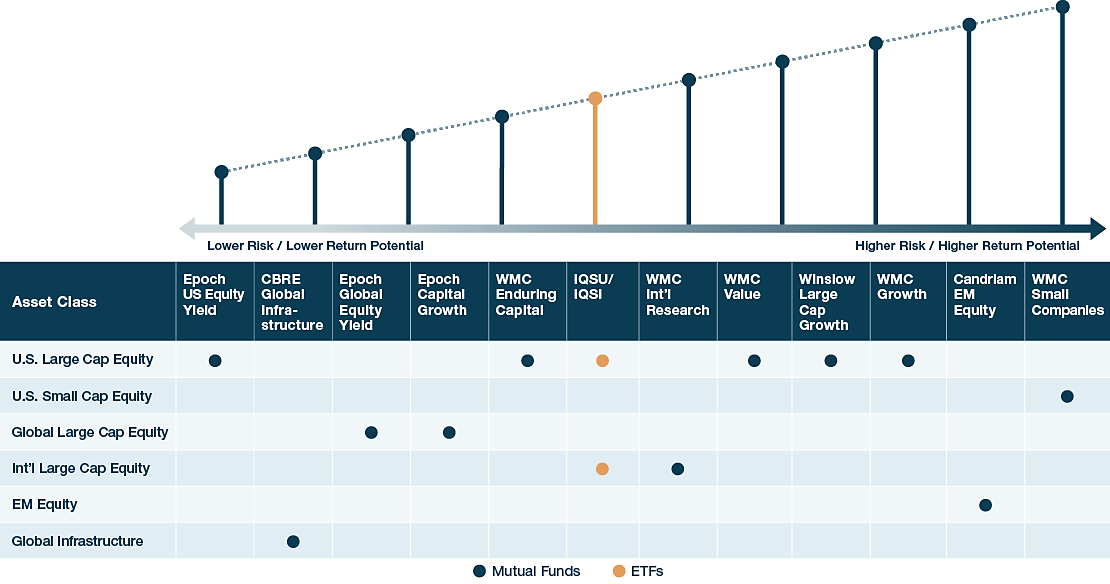

Investing for longevity across the risk-return spectrum

New York Life Investments' multi-boutique structure provides investors with a full line-up of solutions across regions and market caps, designed to build portfolios for the long term.

Past performance is no guarantee of future results. There can be no assurance that investment objectives will be met. Relative risk spectrum is a hypothetical representation for illustration only. The funds mentioned above are both IndexIQ ETFs and MainStay Funds. The prospectus, investment objectives, performance, risk, and other important information can be found on the current Fund page. Returns represent past performance which is no guarantee of future results. Current performance may be lower or higher. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Visit nylinvestments.com/etfs and nylinvestments.com/funds for the most recent month-end performance.

Performance data quoted represents past performance. Past performance is no guarantee of future results. Due to market volatility, current performance may be less or higher than the figures shown. Investment return and principal value will fluctuate so that upon redemption, shares may be worth more or less than their original cost. Performance figures for all Funds reflect contractual waivers and/or expense limitations, without which total returns may have been lower. These limitations may be modified or terminated only with Board approval.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance (this does not include the effects of sales charges, loads, and redemption fees). The top 10% of products in each product category receive 5stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Click on the product name for the most recent overall risk-adjusted Morningstar ratings shown above, including ratings by share class and time period and the number of funds in each category. The Fund page also includes the prospectus, investment objectives, performance, risk and other important information.