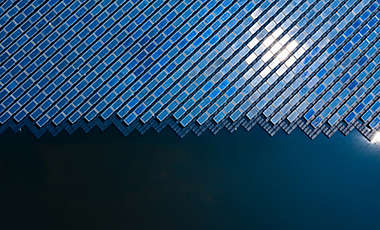

CBRE Global Infrastructure SMA

CBRE Investment Management seeks total return by investing across the global listed infrastructure universe.

Fiera Capital International ADR SMA

Seeks to achieve long-term capital growth by investing in a dynamic combination of stable and emerging growth stocks of international companies as it seeks to outperform its benchmark, the MSCI ACWI EX-US Index.

Fiera Capital Small Cap Growth SMA

Seeks to achieve long-term capital growth by investing in a dynamic combination of stable and emerging growth stocks of small and mid-cap growth-oriented companies as it seeks to outperform its benchmark, the Russell 2000 Growth Index.

Fiera Capital Tax Efficient Core Intermediate 1-10 Yrs SMA

Seeks to generate tax efficient, risk-adjusted returns with an emphasis on generating a lower volatility return stream, through a capital preservation focused investment process.

Fiera Capital Tax Efficient Core Plus SMA

Seeks to generate a high level of tax efficient yield with an emphasis on total return, through a capital preservation and then growth focused investment process.

Fiera Capital Tax Efficient Short Intermediate SMA

Seeks to generate tax efficient, risk-adjusted returns with an emphasis on generating a lower volatility return stream, through a capital preservation focused investment process.

NYLI Epoch Global Equity Yield ADR SMA

A global portfolio that seeks to capture shareholder yield with a focus on companies that pay dividends, buy back stock and reduce debt.

NYLI Epoch U.S. Equity Yield SMA

A U.S. portfolio that seeks to provide a high level of income by investing in a diversified portfolio of stocks with a history of attractive dividends and positive growth in free cash flow, which may be used to pay future dividends.

NYLI MacKay Convertible Securities Portfolio

A convertible portfolio that invests in securities for total return potential, seeking capital appreciation potential of the underlying equity while retaining fixed-income characteristics.

NYLI MacKay Core Bond Portfolio

Seeks to achieve attractive risk-adjusted returns by identifying diversified sources of alpha across the fixed income market. The portfolio is designed to seek total return by allocating across a broad opportunity set.

NYLI MacKay Core Plus Bond Portfolio

Seeks to achieve attractive risk-adjusted returns by identifying diversified sources of alpha across the fixed income market. The portfolio is designed to seek total return by allocating across a broad opportunity set, including high yield.

NYLI Pathway Multi-Asset Income 50/50

A risk-based, multi-manager and multi-asset class portfolio, the SMA seeks to provide an attractive level of income and capital appreciation.

NYLI Pathway Multi-Asset Income 65/35

A risk-based, multi-manager and multi-asset class portfolio, the SMA seeks to provide an attractive level of income and capital appreciation.

NYLI Pathway Multi-Asset Income 35/65

A risk-based, multi-manager and multi-asset class portfolio, the SMA seeks to provide an attractive level of income.

Winslow Focused Large Cap Growth SMA

A large cap growth portfolio that seeks long-term growth of capital from investments in U.S. large cap growth equities.

Winslow U.S. Large Cap Growth SMA

A large cap growth portfolio that seeks to consistently outperform the Russell 1000® Growth Index over time on a risk-adjusted basis by investing in U.S. large cap growth equities.

Investment objectives may not be met as the underlying investment options are subject to market risk and fluctuate in value. Please keep in mind that there are fees and expenses associated with investing in managed accounts. Accordingly, you can lose money investing in a separately managed account.

There is no guarantee that any strategies discussed will be effective.

ESG Investing Style Risk Impact investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, certain ESG strategies may limit exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating. There is no assurance that employing ESG strategies will result in more favorable investment performance.