Happy Mother's Day! In honor of this special occasion, we want to pay tribute to three remarkable women who are not only influential in the world of economics and markets, but also happen to be mothers. We will also explore how each of them fits into current market themes and investment opportunities (hold out til the end).

Janet Yellen, U.S. Treasury Secretary & the debt ceiling

Secretary Yellen is no stranger to breaking glass ceilings, but now she finds herself holding up the U.S. debt ceiling. With policymakers still attempting to secure concessions from the opposing side (they met once last week and postponed another meeting to this week), Secretary Yellen has been implementing "extraordinary measures" (since January) to stretch the federal budget, such as suspending certain types of investments in savings plans for government workers and temporarily moving money between government agencies to make payments as they come due.

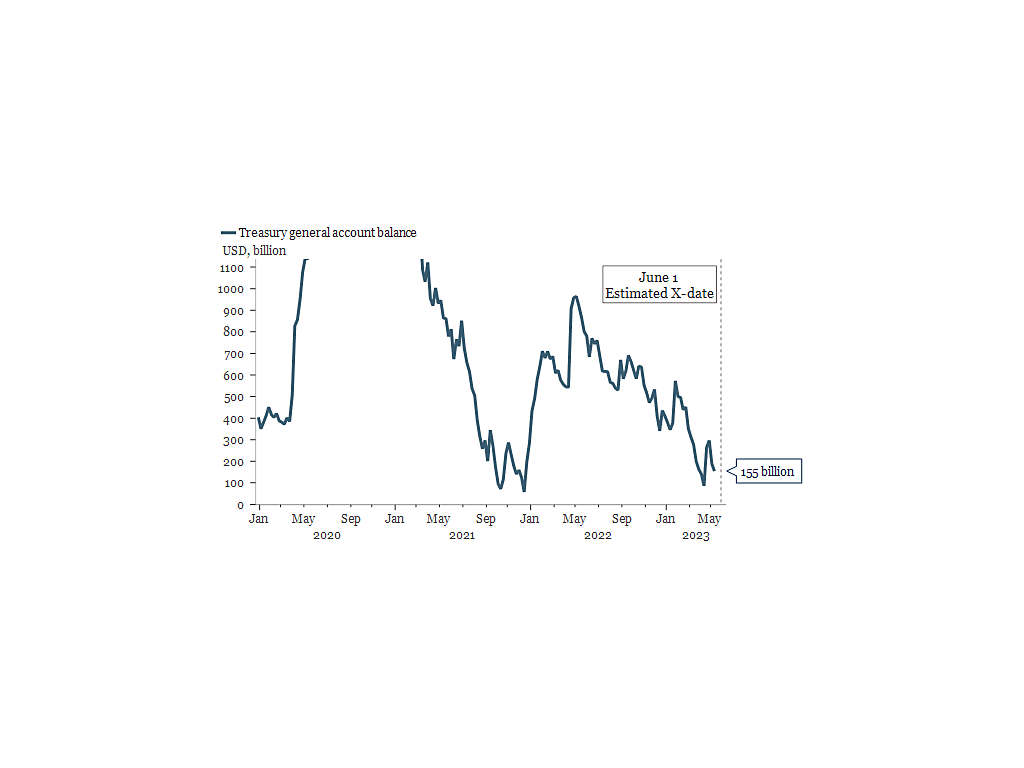

Why is the X-date just an estimate?

The challenge lies in accurately predicting cash inflows, such as tax revenues, and dealing with the uncertainty surrounding the extent and duration of extraordinary measures. That said, outflows are relatively more predictable, with numerous significant payments required in the first few days of June, including for social security and interest payments. As a result, Secretary Yellen has pointed to June 1 as the most likely X-date. (Chart 1).

The U.S. Treasury is closing in on the 'X-date"

Source: New York Life Investments Multi-Asset Solutions, Fed, Macrobond, 5/11/23. The Treasury General Account is the U.S. government's operating account that is maintained by primarily Federal Reserve Banks and their branches to handle daily public money transaction. Y-axis truncated at $1.1 trillion.

Ideal Mother's Day gift: Chocolate – Secretary Yellen is a known chocoholic.

Lael Brainard, Director of the National Economic Council, Former Fed Vice Chair & the power of Fed speak

Back in April 2022, during the early stages of the Fed hiking cycle, then-Fed board member Brainard (who was awaiting confirmation as Vice Chair) gave a surprising hawkish speech calling for rate hikes and faster quantitative tightening. This hawkish speech carried extra power because she was perceived as a dove on monetary policy— her speech led to a jump in the U.S. government 10-year bond yield to a new high and a drop in equity prices. To the surprise of many, Brainard left a hawkish mark on the Fed board when she later answered the call to run the national economic council.

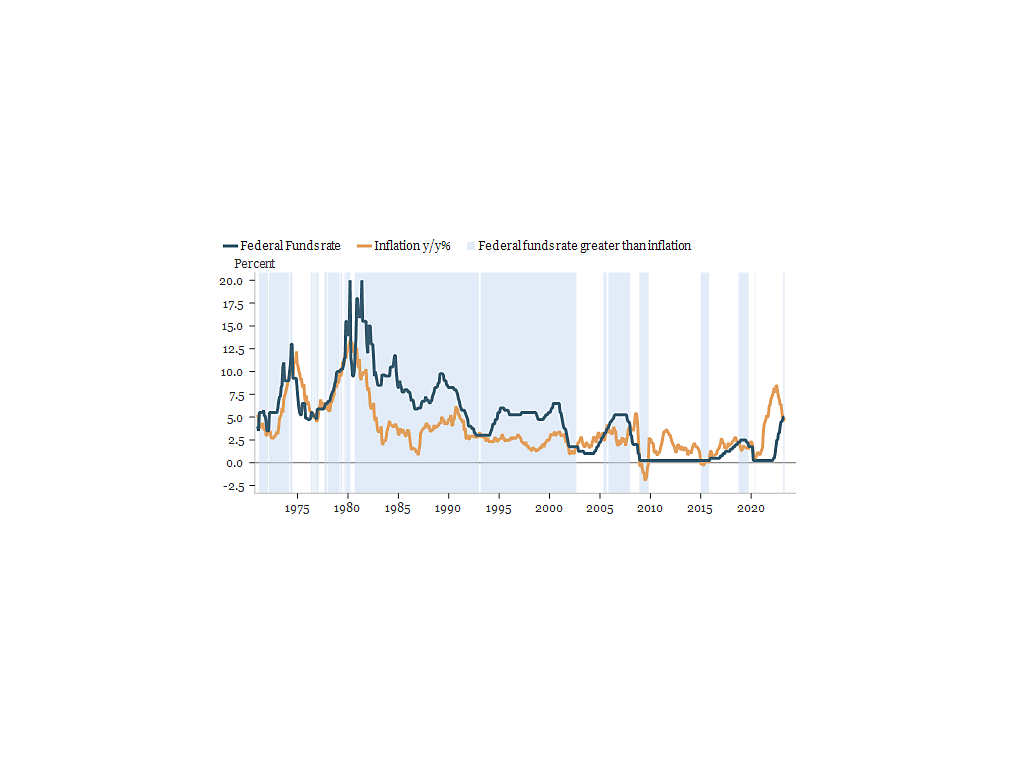

Brainard's speech serves as a reminder that Fed speak, particularly in the later stages of the cycle, can have a significant impact on markets. The bond market is currently pricing in roughly three rate cuts by the Fed this year, which could be supporting the recent equity performance. As Fed members give speeches in the coming weeks and months, they will likely emphasize that the Fed will need to maintain rates at peak levels until there are signs of inflation returning to target levels. We expect markets to react as they price in higher rates for longer.

Chart 2 gives us the historical argument for why the Fed will need to hold rates at peak levels. Following its most recent rate hike, the Fed has raised the Federal Funds rate above inflation. But this chart suggests that the spread between Fed Funds and inflation will need to widen further (the Fed should remain on hold as inflation falls), and this should remain the case for an extended period before the Fed initiates rate cuts. In sum: between the Fed’s signaling and historical context, we think the market is wrong to expect rate cuts in 2H 2023.

The Fed Funds rate now exceeds the rate of inflation...but only by 0.25%

Source: New York Life Investments Multi-Asset Solutions, Bureau of Labor Statistics, Federal Reserve, Macrobond, 5/11/23. The Federal Funds rate is the target interest rate set by the Federal Reserve at which commercial banks borrow and lend their extra reserves to one other overnight. Inflation 7/7% is represented by the annual change of the Consumer Price Index. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Ideal Mother's Day gift: Packing cubes – Director Brainard is a veteran globetrotter. She was born to American diplomats and spent many years living overseas. In previous government roles, she traveled throughout Europe, sounding the alarm about the potential spread of the Greek debt crisis. Additionally, she played a critical role in negotiating the now-defunct Trans-Pacific Partnership agreement in Asia.

Christine LaGarde, President of the European Central Bank & international assets

When a crisis hits, President LaGarde is who you want in your corner. Having successfully navigated the global financial crisis during her tenure as the French finance minister and then tackling the Eurozone debt crisis as the head of the International Monetary Fund in 2011, she is known as one of the world’s best problem solvers. Since taking charge at the European Central Bank (ECB) three-and-a-half years ago, she has faced the daunting challenges posed by the Covid-19 pandemic and Russia's invasion of Ukraine.

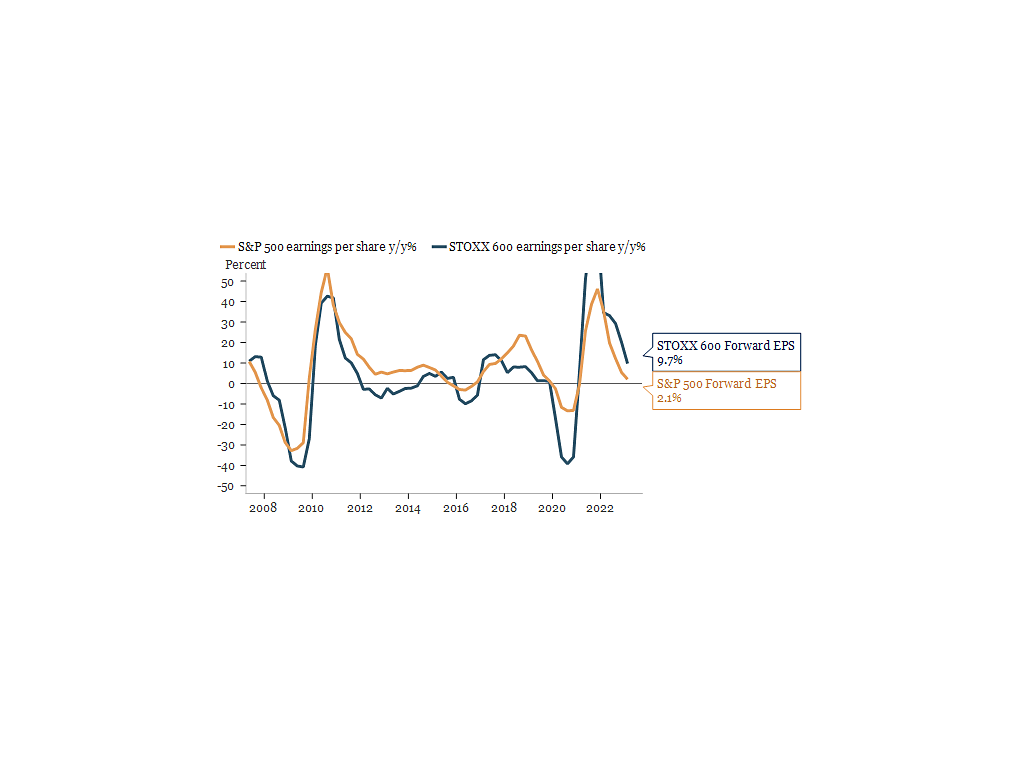

These days, President LaGarde, like Fed Chair Powell, is engaged in a battle against inflation. The ECB has entered the final stage of its rate hike cycle, after raising interest rates at every policy meeting since July of last year, totaling an increase of 375 basis points.

While President LaGarde has spearheaded the most aggressive monetary policy tightening cycles since the inception of the euro, it is worth noting that European equities tend to exhibit less sensitivity to interest rate fluctuations due to their sector composition and high concentration of value equities. As high interest rates weigh on U.S. and European equities, European earnings growth may display greater resilience to the impact of these rate hikes. Chart 3 below shows that as the U.S. and European economies approach this slowdown, European equities continue to price in growth, while growth in U.S. earnings is dwindling.

European earnings growth is outpacing U.S. earnings growth

Source: New York Life Investments Multi-Asset Solutions, Federal Reserve, ECB (European Central Bank), Macrobond, 5/11/23. The S&P 500 Index is an unmanaged index that is widely regarded as the standard for measuring large-cap U.S. stock market performance. The STOXX 600 Index represents large, mid, and small capitalization companies across 17 countries of the European region. Compared to the S&P 500, STOXX 600 has a greater allocation to the Financials, Industrials, and Consumer Staples sectors and a lower allocation to the Technology and Communication sectors.

Ideal Mother’s Day gift: Goggles – President LaGarde was a member of the synchronized swimming team that won the French national championship in 1973 and is still an avid, health-conscious vegetarian.

Note: Regrettably, the list of influential mothers in the market is disappointingly short, and it is crucial that we continue to support and advocate for equality in all spheres.

Portfolio strategy

We discussed the impact these remarkable mothers are making on the world. Below, we examine how their tireless efforts in maintaining the stability of the global economy align with the current investment opportunities.

Janet Yellen and the debt ceiling debacle should remind investors that when the debt ceiling is raised Yellen is planning on refilling the Treasury general account back up to $500 billion. That means Treasury will be drawing down on market liquidity which has tended to create volatility. Therefore, it would be prudent to remain invested and prioritize quality in the equity space. Look for stocks with high return-on-equity, low earnings variability, and low leverage, which help mitigate the impact of falling market liquidity. We also like large-cap and value equities, because they could be areas of the market investors turn to if things get shaky.

Lael Brainard and the power of Fed speak bring attention to the possibility that the rates market might not fully grasp the extent to which the Fed will maintain higher rates to combat inflation. Additionally, quantitative tightening measures can further support the long end of the yield curve. We’d advise avoiding long-term Treasuries and instead maintain a short or neutral duration position. If adding duration, consider tax-free and taxable municipal bonds.

Christine Lagarde’s deft management of the European economy keeps the door open for investors considering diversifying with European equities. However, the dollar is likely to strengthen in a recessionary environment so we think a 50% currency hedged strategy could be a suitable approach. And let's not overlook the fact that Europe is taking the lead in the green energy transition making global listed infrastructure another way to tap into its growth. European infrastructure equities dominated the first quarter of 2023 while U.S. infrastructure equities posted negative returns.

1. The X-date refers to the day the U.S government does not have the cash on hand to service its current debts.

This material represents an assessment of the market environment as at a specific date; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding any funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

“New York Life Investments” is both a service mark, and the common trade name, of certain investment advisors affiliated with New York Life Insurance Company. Securities are managed by New York Life Investment Management LLC and distributed by NYLIFE Distributors LLC, 30 Hudson Street, Jersey City, NJ 07302.

5682704

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.