I believe in the power of what we can do together.

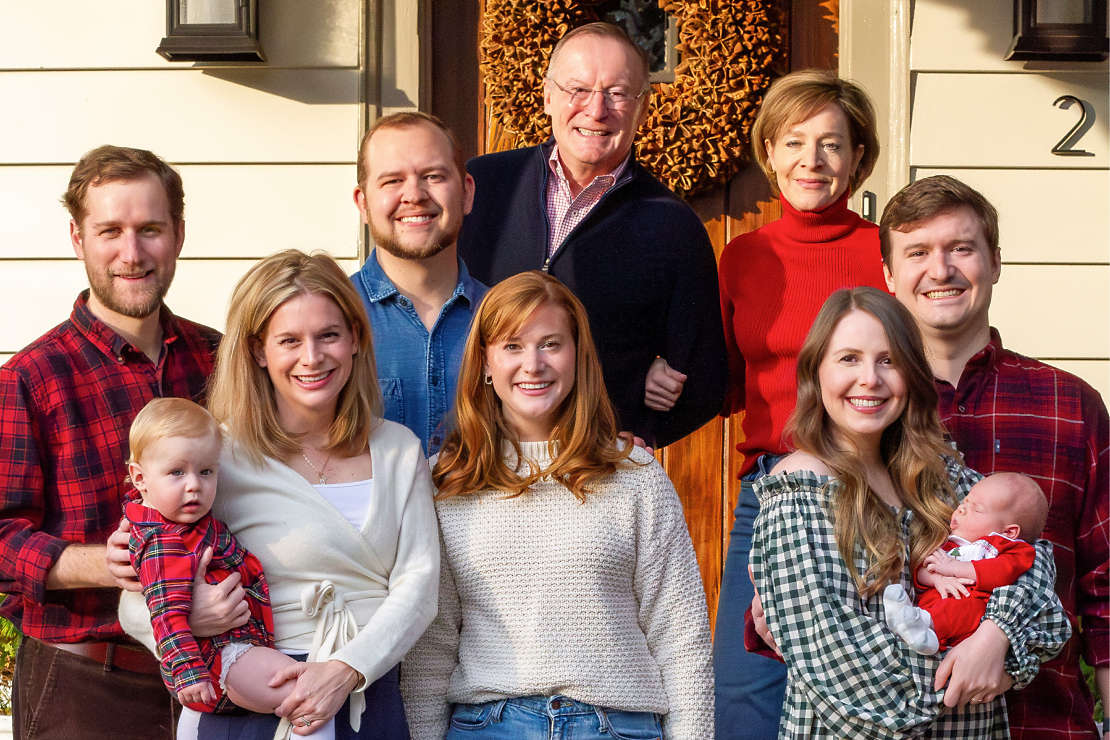

Hello, my name is Jeff Findling, your Strategic Wealth Advisor Consultant with New York Life Investments. I was born and raised in western Michigan and attended Marquette University in Milwaukee where I met my wife, Juli. We started out our post-college life in Detroit in 1983 and, on a whim, relocated to the Atlanta area in 1988 to escape the cold. We are blessed with three married adult children, two grandsons and a third one on the way. They all live within walking distance of our home. My interests include music, history, travel, comedy and of course, SEC Football (Go Dawgs). I particularly enjoy spending time with our ever-growing family and the many friends we have made in Atlanta over the years.

The investment business found me 41 years ago when I started as an Account Executive with E.F. Hutton. I have been in the industry since 1983 and privileged to work with New York Life Investments for the past 24 years. I believe that the components of a great business relationship/friendship are built on the same principles today as they were in 1983. They are trust, honesty, empathy, humility, objectivity and conviction. All delivered with a good sense of humor too.

I welcome the opportunity to work with you to become a trusted partner for you, as well as your clients.

4 Ways to Strengthen Investment Portfolios Today

Turn obstacles into opportunities with actionable insights and several highly rated solutions.

Let’s have a conversation. I’m here to support you.

New York Life Investments is deeply committed to helping you make informed financial decisions. Along with our timely insights, I hope you will see me as a valuable resource that can help you build resilient portfolios across market cycles. For more information about New York Life Investments, visit newyorklifeinvestments.com.

Jeff Findling

Advisor Consultant

P: 1-646-422-9471 E: jmfindling@nylinvestments.com

FOR REGISTERED REPRESENTATIVE USE ONLY. NOT TO BE USED WITH THE GENERAL PUBLIC.

Investing involves risk, including possible loss of principal. Asset allocation and diversification may not protect against market risk, loss of principal, or volatility of returns. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors, and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. No representation is being made that any account, product, or strategy will or is likely to achieve profits. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Clients should consult your tax or legal advisor regarding such matters. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

All investments are subject to market risk, including the potential loss of principal. Past performance is not indicative of future results. Investment returns and principal value will fluctuate, and investors may experience gains or losses upon redemption.

Fixed income securities are subject to interest rate risk; when interest rates rise, bond prices generally fall. They are also subject to credit risk, where the issuer may fail to make timely payments of interest or principal. High-yield (non-investment-grade) securities carry a greater risk of default and price volatility compared to higher-rated securities. Short-duration strategies may help mitigate interest rate risk but can still be affected by changes in interest rates and market conditions.

Growth stocks can face significant price declines if earnings fall short of investor expectations, even if they grow. Early-stage growth companies face higher risks. The main risk of value stock is that a security's price may not reach its expected value. Small and mid-cap securities carry higher risks, including sharp price fluctuations, limited liquidity, and unpredictable changes, especially over the short term. Investing in foreign securities carries risks, such as currency fluctuations, unstable markets, limited information, and political or economic challenges. Emerging markets often face higher risks than developed ones.

This material is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. The information provided does not consider the specific objectives or circumstances of any particular investor. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with their financial professionals.