The Current Global Landscape

As the world grapples with escalating crises, geopolitical tensions, and environmental challenges, the dynamics of globalization are undergoing a profound transformation. The traditional model of global trade and interconnected economies that has prevailed for decades is giving way to a new paradigm. This new paradigm is characterized by a resurgence of national security and sovereignty.

According to moderator Michael LoGalbo, CFA, Multi-Asset Portfolio Strategist at New York Life Investments, "the pandemic, Russia’s invasion of Ukraine, U.S.-China competition, and climate change have reset the previous economic model, which prioritized globalized cost reduction and efficiency, to reflect countries’ new primary interests – national security and access to resources."

In the realm of technology, producing semiconductors and computer chips is a linchpin of our increasingly digital world. Michael emphasized, "The world as we know it could not function without Taiwan's semiconductor manufacturing company, TSMC, which produces over 52% of the world's semiconductors and over 90% of all of the advanced processing capacity."

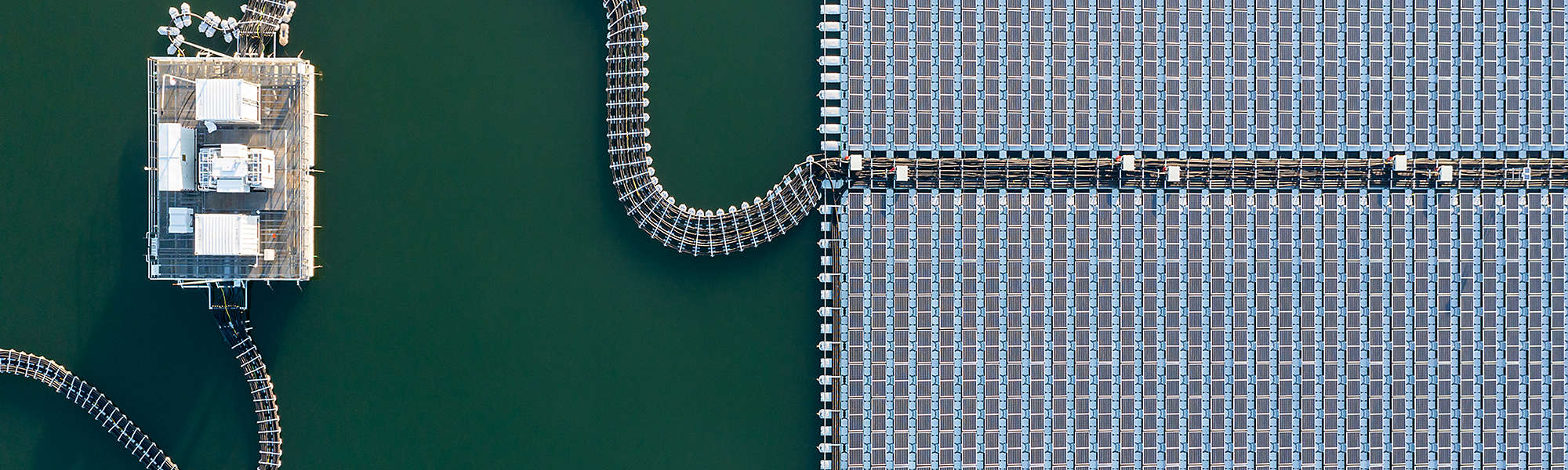

Efforts to achieve energy independence in green and traditional sources face stark challenges. Michael highlighted, "We’re seeing an urgent need not just for innovation in clean power but also in nuclear capacity, battery storage, and metal and minerals recycling."

Investing in Infrastructure's Power

Dan Foley, CFA, Portfolio Manager at CBRE Investment Management, pointed out that infrastructure assets such as utilities, communications, midstream energy, and transportation are known for their income-driven models, low volatility, diversification, and growth potential. He noted, "Typically, they are income-driven business models with predictable rates of return, low volatility, diversification, growth potential, and cash flow streams that are often inflation protected."

Foley identified four converging themes—decarbonization, energy security, asset modernization, and digital transformation—that are poised to drive a significant increase in infrastructure investment by 2040. He highlighted how "The Inflation Reduction Act (IRA) tackles the twin challenges of fighting climate change and providing energy security in the U.S."

Unlocking Investment Opportunities for Municipals

Bob Burke, CFA Managing Director at MacKay Municipal Managers, emphasized the role of federal programs in stimulating infrastructure investment at the municipal level. He highlighted that these programs, in combination with municipal issuers' investments, have the potential to drive substantial capital improvements.

Bob explained that the IRA is particularly significant for municipalities, offering flexibility in funding projects and renewable energy initiatives. He said, "It’s a framework that has created flexibility for states and local governments to participate using the technology best befitting their regions."

Embracing Opportunities in (Re)globalization

In conclusion, our experts challenged the prevailing narrative of de-globalization and encouraged investors to look beyond this perspective. They emphasize the emerging opportunities within the (re)globalization trend, particularly in infrastructure sectors essential to national interests like technology, energy, and global finance. As the world undergoes significant changes, thinking imaginatively about production and process shifts is vital for investors seeking to leverage these unique opportunities.

The opinions expressed are solely those of the guest speakers and subject to change. This material is distributed for informational purposes only. Forecasts, estimates, and opinions contained herein should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Any forward-looking statements speak only as of the date they are made, and the guest speakers and New York Life Investments assume no duty and do not undertake to update forward-looking statements. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of New York Life Investments.

New York Life Investment Management LLC engages the services of federally registered advisors. CBRE Investment Management is unaffiliated with New York Life Investment Management or its affiliates. MacKay Municipal Managers is a trademark of MacKay Shields LLC. MacKay Shields LLC is a wholly owned subsidiary of New York Life Investment Management Holdings LLC, which is wholly owned by New York Life Insurance Company.

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.