Insights

Insights

Municipal Insights

Get insight into the highly fragmented, complex, and inefficient municipal bond market from the seasoned, active investors at MacKay Municipal Managers. Watch the latest videos and listen and subscribe to our Muni 360 podcast to hear the team’s in-depth conversations on all-things muni.

Top 5 Muni Market Insights 2025: Mid-Year Update

Finding Value in a Shifting Muni Market

Municipal Bond Market Update: Key Performance Drivers

Consider MSTIX Amid Declining Money Market Yields

2025 Municipal Market Outlook

2024 Municipal Bond Market Insights: Mid-year Update

Opportunities in Active Municipal Bond Fund Management

The MacKay Municipal Managers Difference

Investment Insights: Power of Tax Equivalent Yield

Investment Idea: Attractive Alternatives to T-Bills

Morningstar Magazine: Complementing the Core

Investment Insights: T-Bill Yields Are Projected to Decline

A Golden Opportunity - California Municipal Bonds

Keep More of What You Earn with Municipal Bonds

Five Tax Tips for Investors

Investing Essentials: The Power of Taxable Equivalent Yield (National)

Muni 360

Muni 360

Muni 360

Podcast: Listen and Subscribe

Listen to in-depth conversations, as the seasoned, active investors at MacKay Municipal Managers share their latest views on the municipal market.

Subscribe to get the latest Muni 360 Podcast episode delivered to your inbox.

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.

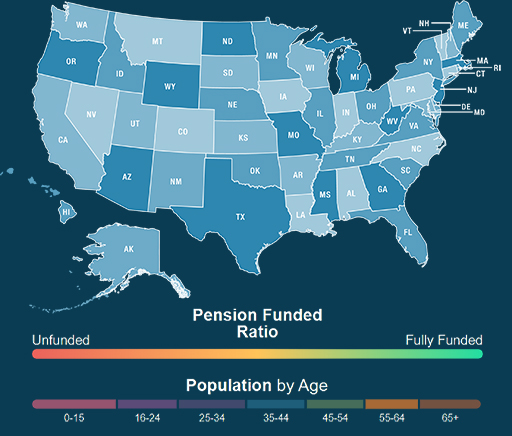

State by State Breakdown

Use this interactive tool for key statistics that summarize each state's municipal profile.

Muni 360 Report

Get a comprehensive view into the municipal market alongside insights from MacKay Municipal Managers.

MacKay Municipal Managers

MacKay Municipal Managers

MacKay Municipal Managers

MacKay Municipal Managers™

The Minds Behind Munis

The experience of a large firm. The approach of a nimble, autonomous boutique. Plus, fund managers with a personal touch and a track record of success. All of which means we have the insights, experience and solutions you need to help take advantage of the municipal bond market. A recognized leader in active municipal bond investing, the team at MacKay Municipal Managers averages over 20 years of industry experience, and its Co-CIOs have worked together since 1993.

John Loffredo, CFA

Vice Chairman

Robert DiMella, CFA

Executive Managing Director

Asset Allocation Guides

Asset Allocation Guides

Municipal Bond Asset Allocation Guides

For Advisors Only

MacKay Municipal Managers provides its municipal bond asset allocation portfolios for investors seeking to construct blended exposures. For Financial Advisors looking to build their clients’ portfolios, download our Municipal Bond Asset Allocation Guide.

Investors, please inquire about our guide with your financial advisor.

Download State-Specific Asset Allocation Guides:

The Asset Allocation Guides provide financial advisors and their clients with a framework that incorporates the related concepts of investor objectives and relative risk. This should be viewed in the context of a starting point in the conversation that takes place between the advisor and the client.

What’s Your Risk Tolerance?

Download the guides for more details, including suggested allocations for Conservative, Moderate and Aggressive investors.

Solutions

Solutions

Explore Our Highly Rated Muni Solutions

Our Municipal Suite of Solutions

Performance data quoted represents past performance. Past performance is no guarantee of future results. Due to market volatility, current performance may be less or higher than the figures shown. Investment return and principal value will fluctuate so that upon redemption, shares may be worth more or less than their original cost. Performance figures for all Funds reflect contractual waivers and/or expense limitations, without which total returns may have been lower. These limitations may be modified or terminated only with Board approval.

Click on the product name for the most recent overall risk-adjusted Morningstar ratings shown above, including ratings by share class and time period and the number of funds in each category. The Fund page also includes the prospectus, investment objectives, performance, risk and other important information.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance (this does not include the effects of sales charges, loads, and redemption fees). The top 10% of products in each product category receive 5stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

National and State-specific Strategies Across the Income and Risk Spectrum

This is a hypothetical illustration showing relative potential risk and yield. Risk based on standard deviation. *National muni tax-equivalent yield based on 40.80% tax level (37% highest federal tax bracket plus the 3.8% Medicare surcharge). CA and NY muni tax equivalent yield based on the blended rates derived from a top federal income tax rate of 37%, the 3.8% Medicare tax, top state income tax rates of 8.82% and 13.30% in New York and California, respectively. Past performance is no guarantee of future results, which will vary. All mutual funds are subject to market risk and will fluctuate in value. Corporate High Yield Bonds index is represented by the Bloomberg Barclays High-Yield Corporate Bond Index. The U.S. Corporate bond index is represented by the Bloomberg Barclays U.S. Corporate Bond Index. The U.S. Treasury index is represented by the Bloomberg Barclays U.S. 1-3 Year Government/Credit Index. The U.S. Aggregate bond index is represented by the Bloomberg Barclays U.S. Aggregate Bond Index.

Historical Insights

Historical Insights

Historical Insights

2025 Municipal Market Outlook

2024 Municipal Market Outlook

2023 Municipal Bond Market Insights

2021 Municipal Bond Market Insights

2020 Municipal Bond Market Insights

2019 Municipal Bond Market Insights

2018 Municipal Bond Market Insights

2017 Municipal Bond Market Insights

2016 Municipal Bond Market Insights

2015 Municipal Bond Market Insights

2014 Municipal Bond Market Insights

2013 Municipal Bond Market Insights

2012 Municipal Bond Market Insights

2011 Municipal Bond Market Insights

The Morningstar Medalist RatingTM is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to global.morningstar.com/managerdisclosures/.

The Morningstar Medalist Rating (i) should not be used as the sole basis in evaluating an investment product, (ii) involves unknown risks and uncertainties which may cause expectations not to occur or to differ significantly from what was expected, (iii) are not guaranteed to be based on complete or accurate assumptions or models when determined algorithmically, (iv) involve the risk that the return target will not be met due to such things as unforeseen changes in management, technology, economic development, interest rate development, operating and/or material costs, competitive pressure, supervisory law, exchange rate, tax rates, exchange rate changes, and/or changes in political and social conditions, and (v) should not be considered an offer or solicitation to buy or sell the investment product. A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate.

© 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Bloomberg High-Yield Corporate Bond Index is a rules-based, market-value-weighted index engineered to measure publicly issued non-investment grade USD fixed-rate, taxable and corporate bonds. Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers. Bloomberg U.S. 1-3 Year Government/Credit Index includes investment-grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury, with maturities of one to three years. Index results assume the reinvestment of all capital gain and dividend distributions. Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities.

Active management is the use of a human element, such as a single manager, co-managers or a team of managers, to actively manage a fund’s portfolio. Active management strategies typically have higher fees than passive management.

Please note that not all products may be available for sale to all registered representatives and agents. Please consult your firm guidelines. Please note that not all products may be available for sale to all registered representatives and agents. Please consult your firm guidelines.