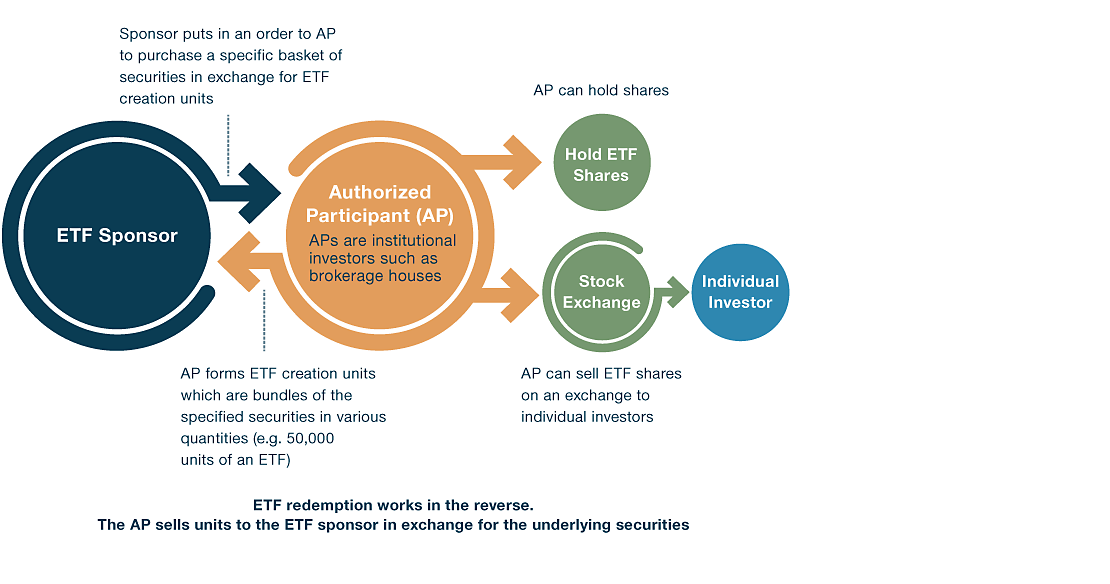

For instance, if an ETF is designed to track the S&P 500 Index, the authorized participant needs to buy shares in all the S&P 500 companies in the exact same weights as the Index, then deliver those individual shares to the ETF provider.

In exchange, the ETF provider gives the authorized participant a block of equally-valued bundled ETF shares, called a “creation unit.” Creation units are usually formed in blocks of 50,000 ETF shares. In this instance, both parties benefit from the transaction. The ETF provider gets the stocks it needs to bundle into ETF shares and track the Index, and the authorized participant gets an equivalent value of ETF shares to trade on the open market.

The process can also work in reverse. An authorized participant can remove ETF shares from the market by purchasing enough of those ETF shares to form a creation unit, and then deliver that creation unit to the ETF issuer in exchange for the same value in the underlying securities of the respective ETF.

Creating and Redeeming Shares Helps Maintain a Flexible Supply and ETF Price Consistency