- While we assign a low probability to a near-term resolution due to immense complexities, any substantial change to their current structure carries the potential for severe impacts on housing affordability, financial market stability, and the broader economy.

- Key hurdles to privatization include resolving the U.S. Treasury's substantial financial stake, addressing a significant regulatory capital shortfall, and determining the future of the government guarantee that currently supports the GSEs.

The Renewed Push for GSE Privatization

Recent discussions have brought the future of Fannie Mae and Freddie Mac (“F&F”) back into the spotlight. Comments from administration officials regarding the GSEs' role in a sovereign wealth fund, alongside reports of the White House considering steps toward ending their conservatorship, have fueled investor interest. The core idea posited is that selling the government's ownership stake in F&F through public equity markets could generate substantial proceeds for the U.S. Treasury.

Current Role and Market Dominance of Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac are central to the U.S. housing finance system, ensuring a stable supply of mortgage financing and promoting homeownership. They operate in the secondary mortgage market by purchasing mortgages from lenders, pooling them into mortgage-backed securities (MBS), and selling these securities to investors with a guarantee of payment.

Crucially, beyond their explicit guarantees, an implicit guarantee exists: markets widely believe the U.S. government would intervene to support the GSEs' obligations, preventing default. This perception allows GSE-issued securities to be viewed as nearly risk-free, enabling the GSEs to borrow at rates close to U.S. Treasuries and hold credit ratings comparable to the federal government. Currently, the GSEs back approximately 50% of all outstanding U.S. mortgage debt, amounting to $6.6 trillion. This government backing translates into lower mortgage rates for borrowers and supports the prevalence of the 30-year fixed-rate mortgage with prepayment rights, a unique feature of the U.S. market that provides payment stability and refinancing opportunities.

The Path to Privatization: Critical Hurdles

Successfully privatizing Fannie Mae and Freddie Mac involves overcoming several monumental obstacles:

Resolving the U.S. Treasury's Financial Stake

Following the 2008 financial crisis, the GSEs were placed into conservatorship, with the Treasury providing approximately $190 billion in capital support. In return, the Treasury received senior preferred shares and warrants to purchase up to 79.9% of the GSEs' common stock. While the GSEs have since paid $300 billion in dividends, recent amendments allow them to retain earnings to build capital. To compensate taxpayers for these forgone dividends, the U.S. Treasury Department reports that the liquidation preference on its senior preferred stock has increased, standing at $340 billion as of the third quarter of 2024. Addressing this substantial liquidation preference is a primary challenge, as it directly impacts the feasibility of raising new private capital and the returns available to potential new shareholders. The political viability of the Treasury forgiving a significant portion of this $340 billion claim is also questionable.

The Future of the Government Guarantee

The nature of any future government support is paramount.

Explicit Guarantee

This would likely require Congressional action and involve a fee paid to the Treasury for assuming credit risk, similar to Ginnie Mae. This could increase costs for borrowers but might maintain market stability.

Implicit Guarantee

If conservatorship ends without an explicit guarantee, markets might still assume some level of government backstop. However, this uncertainty would likely increase borrowing costs and volatility for the GSEs. Rating agencies like Moody's have indicated that a reduction in government support could lead to a one- to three-notch downgrade in the GSEs long-term debt ratings. Fitch Ratings noted that without the Preferred Stock Purchase Agreements (PSPAs) or equivalent support, GSE ratings would be evaluated on a standalone basis, considering their monoline business models.

No Guarantee

This scenario would likely lead to the most significant increase in funding costs and market disruption. The US Department of Housing and Urvan Development (“HUD”) report from 1996, while dated, suggested that GSE borrowing costs could rise by 30-75 basis points without their agency status.

Currently, fixed income markets appear to price in a continued government guarantee, evidenced by narrow agency MBS spreads over Treasuries. A change in this assumption could cause significant spread widening.

Recapitalization Needs

Despite recent earnings retention, Fannie Mae and Freddie Mac remain significantly undercapitalized. As of September 30, 2024, their combined net worth was $147 billion, far below the FHFA's Enterprise Regulatory Capital Framework (ERCF) requirement of $328 billion (Fannie Mae: $187 billion, Freddie Mac: $141 billion). This leaves a regulatory capital shortfall of $181 billion. Building this capital organically through retained earnings, assuming $25 billion in combined annual earnings, could take approximately seven years. An IPO might accelerate this, but the sheer scale of capital needed, on top of resolving Treasury's stake of $340 billion, presents a formidable challenge. The private capital needed to satisfy both the regulatory capital shortfall and the U.S. Treasury’s stake is staggering (Figure 1). Furthermore, fully private entities would likely face market demands for even higher capital levels to compensate for the absence of a government backstop.

Figure 1: The Treasury Recapitalization Mountain

Source: Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), Federal Housing Finance Agency, U.S. Treasury, Congressional Budget Office.

Potential Market and Economic Ramifications

Privatization, especially without a robust government guarantee, could send shockwaves through the financial system:

Mortgage Rates and Housing Affordability

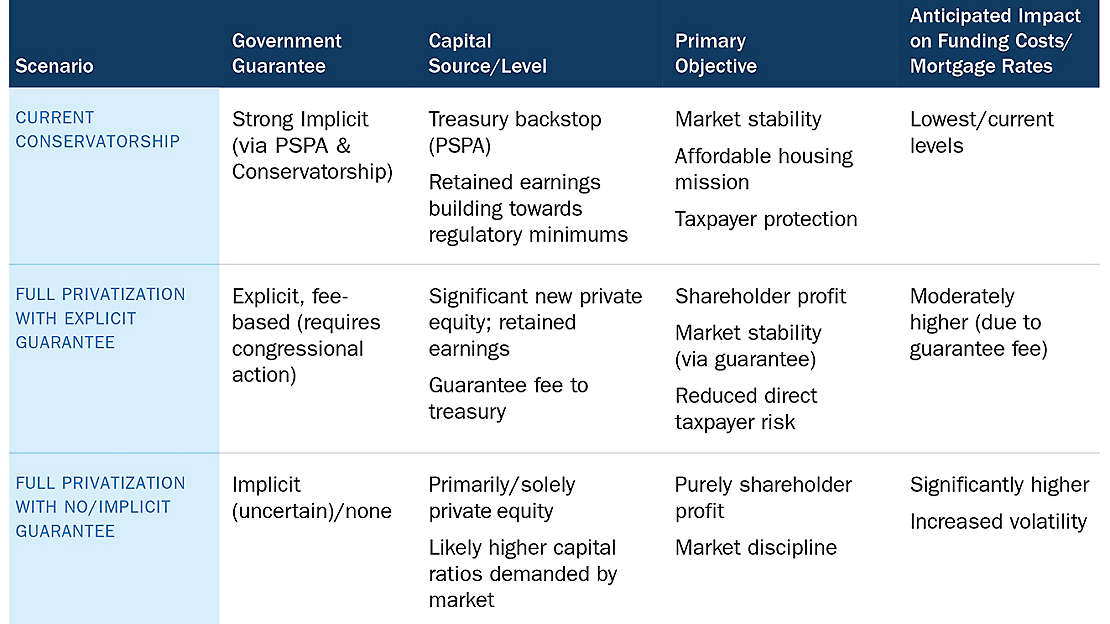

A primary concern is the potential for wider mortgage spreads and increased mortgage rates, negatively impacting consumers and exacerbating housing affordability challenges. While the exact impact is debated, the 1996 HUD report estimated that conforming mortgage rates could be 25-40 basis points higher in a privatized scenario without the GSEs' funding advantage. More recent analyses suggest GSE unsecured funding costs could rise 40-65 bps if rated AA-A without an explicit guarantee. Increased borrowing costs for the GSEs would likely be passed on to homeowners. (See table below)

Impact on Affordable Housing and Underserved Communities

The GSEs currently operate under housing goals mandated to support low- and moderate-income families and underserved areas. Privatization could jeopardize these efforts. The HUD report raised concerns that fully privatized GSEs might:

- Reduce their willingness to develop flexible underwriting standards suitable for affordable lending.

- Scale back marketing, outreach, and educational efforts in underserved communities due to higher costs.

- Offer fewer customized mortgage products for lower-income families. This could lead to tighter underwriting, higher down payment requirements, and an overall reduction in homeownership opportunities, particularly for younger, low-income, and minority homebuyers. The development of the secondary market for multifamily mortgages, which largely serves lower-income families, could also be curtailed.

The Agency MBS and TBA Markets

The To-Be-Announced (TBA) market, with an average daily trading volume of $290 billion in 2024, is critical for mortgage market liquidity and risk management.

UMBS Integrity

Privatizing Fannie Mae and Freddie Mac as separate, competing entities could threaten the viability of the Uniform Mortgage-Backed Security (UMBS), potentially fragmenting the TBA market and reducing liquidity.

Spread Widening and Volatility

Uncertainty about guarantees could lead to higher and more volatile spreads on agency MBS.

Bank Holdings

If GSE guarantees are removed or altered, the risk-weighting and liquidity coverage ratio treatment of agency MBS for banks could change, reducing their appeal. Furthermore, the removal of the GSEs exemption from single-counterparty limits could force large banks to reduce their holdings, shrinking TBA market participation and liquidity.

Foreign Investment

International investors, key holders of agency MBS, might reassess the risk profile of GSE debt if it's no longer seen as a close proxy for U.S. government obligations, potentially shifting demand to Ginnie Mae MBS.

Impact on Financial Institutions

Banks

May become more reluctant to hold significant mortgage portfolios due to negative convexity and lessons from past interest rate cycles. They might prefer originating and selling mortgages in structured product formats. Higher capital charges for MBS could further reduce bank demand.

Non-Banks

While non-bank mortgage originators might expand to fill gaps left by GSEs, their capacity to absorb unguaranteed mortgage risk at scale is uncertain.

GSEs’ Retained Portfolios

Fannie Mae and Freddie Mac hold substantial retained portfolios of MBS (over $95 billion for Fannie Mae and over $100 billion for Freddie Mac as of the draft). If these portfolios are reduced significantly as part of a scaled-back GSE role, it could lead to lower prices and higher yields for agency MBS as a major source of demand diminishes. (See Figure 2)

Monetary Policy Considerations

The efficacy of monetary policy could be affected. If the agency MBS market becomes less liquid or stable, it could diminish a key channel for the Federal Reserve's policy implementation, particularly during periods of market stress.

Figure 2: Size of GSE Retained Mortgage Portfolios

Source: Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), Federal Housing Finance Agency, U.S. Treasury, Congressional Budget Office.

Strategic Alternatives

One alternative discussed is a merger of Fannie Mae and Freddie Mac, potentially yielding administrative efficiencies. However, this would not resolve the fundamental questions of capital and guarantees and could impact perceived differences in their securities' performance. The public utility model has also been mentioned as a theoretical alternative structure.

Key Takeaways for Investors

We believe the path to full privatization is fraught with substantial challenges, making a near-term resolution unlikely. The primary hurdles remain the significant capital shortfall, the resolution of the Treasury's large financial stake, and the uncertain future of the government guarantee. Should privatization proceed, particularly without a strong government backstop, the implications for mortgage rates, housing affordability, and financial market stability could be severe. Investors should monitor:

- Statements and proposals from the Administration and Treasury regarding GSE reform.

- FHFA actions related to capital requirements and conservatorship.

- Congressional discussions regarding potential legislative changes to the GSEs' charters or the provision of an explicit guarantee.

- Market reactions in GSE debt and equity, as well as broader agency MBS spreads.

Ultimately, any significant reform requires careful navigation to balance the objectives of reducing government footprint with maintaining a stable and accessible housing finance system. The current structure, while imperfect, has supported a relatively stable mortgage market.

Figure 3: Scenario Comparison: Future GSE Structure & Guarantee Levels

IMPORTANT DISCLOSURE

Availability of this document and products and services provided by MacKay Shields LLC may be limited by applicable laws and regulations in certain jurisdictions and this document is provided only for persons to whom this document and the products and services of MacKay Shields LLC may otherwise lawfully be issued or made available. None of the products and services provided by MacKay Shields LLC are offered to any person in any jurisdiction where such offering would be contrary to local law or regulation. This document is provided for information purposes only. It does not constitute investment or tax advice and should not be construed as an offer to buy securities. The contents of this document have not been reviewed by any regulatory authority in any jurisdiction.

This material contains the opinions of certain professionals at MacKay Shields and are subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates, and opinions contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Any forward-looking statements speak only as of the date they are made and MacKay Shields assumes no duty and does not undertake to update forward-looking statements. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of MacKay Shields LLC. ©2025, MacKay Shields LLC. All Rights Reserved.

Information included herein should not be considered predicative of future transactions or commitments made by MacKay Shields LLC nor as an indication of current or future profitability. There is no assurance investment objectives will be met.

Past performance is not indicative of future results.

NOTE TO UK AND EUROPEAN UNION RECIPIENTS

This document is intended only for the use of professional investors as defined in the Alternative Investment Fund Manager’s Directive and/or the UK Financial Conduct Authority’s Conduct of Business Sourcebook. To the extent this document has been issued in the United Kingdom, it has been issued by NYL Investments UK LLP, 200 Aldersgate Street, London UK EC1A 4HD, which is authorised and regulated by the UK Financial Conduct Authority. To the extent this document has been issued in the EEA, it has been issued by NYL Investments Europe Limited, 77 Sir John Rogerson's Quay, Block C Dublin D02 VK60 Ireland. NYL Investments Europe Limited is authorized and regulated by the Central Bank of Ireland (i) to act as an alternative investment fund manager of alternative investment funds under the Alternative Investment Fund Managers Directive (Directive 2011/61/EU) and (ii) to provide the services of individual portfolio management, investment advice and the receipt and transmission of orders as defined in Regulation 7(4) of the AIFMD Regulations to persons who meet the definition of “professional client” as set out in the MiFID Regulations. It has passported its license in additional countries in the EEA.

This document only describes capabilities of certain affiliates of New York Life Investments and/or MacKay Shields LLC. No such affiliates will accept subscriptions in any funds not admitted to marketing in your country or provide services to potential customers in your country, including discretionary asset management services, except where it is licensed to do so or can rely on an applicable exemption.

MacKay Shields LLC is a wholly owned subsidiary of New York Life Investment Management Holdings LLC, which is wholly owned by New York Life Insurance Company. "New York Life Investments" is both a service mark, and the common trade name of certain investment advisers affiliated with New York Life Insurance Company. Investments are not guaranteed by New York Life Insurance Company or New York Life Investments.

NOTE TO CANADIAN RECIPIENTS

The information in these materials is not an offer to sell securities or a solicitation of an offer to buy securities in any jurisdiction of Canada. In Canada, any offer or sale of securities or the provision of any advisory or investment fund manager services will be made only in accordance with applicable Canadian securities laws. More specifically, any offer or sale of securities will be made in accordance with applicable exemptions to dealer and investment fund manager registration requirements, as well as under an exemption from the requirement to file a prospectus, and any advice given on securities will be made in reliance on applicable exemptions to adviser registration requirements.

MacKay Shields LLC is a wholly owned subsidiary of New York Life Investment Management Holdings LLC, which is wholly owned by New York Life Insurance Company. "New York Life Investments" is both a service mark, and the common trade name of certain investment advisers affiliated with New York Life Insurance Company. Investments are not guaranteed by New York Life Insurance Company or New York Life Investments.

Subscribe to get MacKay Shields insights delivered to your inbox.

Related Thought Leadership