Overview

Overview

Recognizing the crucial role of computing in our economy coupled with the lack of women in the field, IndexIQ aligned with Girls Who Code (GWC) to develop our EQUL | IQ Engender Equality ETF. By investing in EQUL, you invest in stocks of companies that are leaders in gender equality in the workplace, while simultaneously supporting GWC’s mission.

Why EQUL

Why EQUL

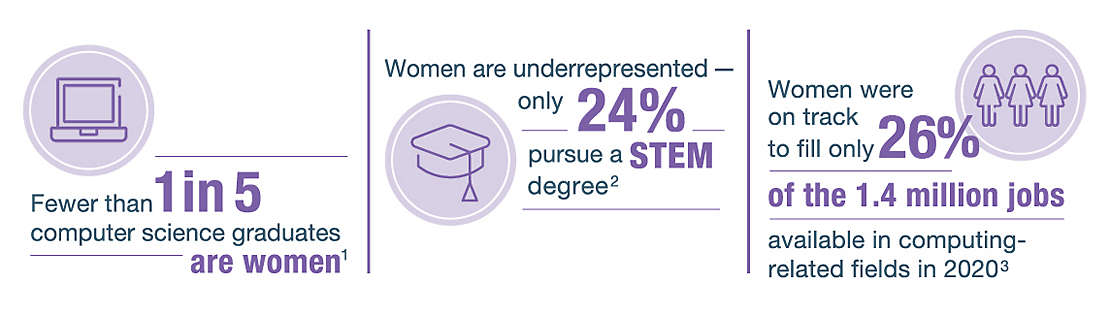

Tackling equality is a data-driven investment opportunity.

Studies indicate that equality-focused opportunities will continue to rise based in part on the following:

To tackle these issues, EQUL utilizes the Gender Equality Scorecard™ developed by Equileap, an independent data provider with a broad scope of gender metrics, enabling investors to make data-informed investment decisions. Equileap evaluates more than 4,000 companies globally across 19 criteria including:

- Gender balance of the workforce, senior management, & board of directors

- Pay gap

- Parental leave

- Sexual harassment

EQUL Portfolio

EQUL Portfolio

Subscribe

Subscribe

Want to learn more about EQUL? Sign up to get regular updates delivered to your inbox.

By subscribing you are consenting to receive personalized online advertisements from New York Life Investments.

EQUL’s Impact

EQUL’s Impact

Inspiring the next generation of tech with Girls Who Code

New York Life Investments and IndexIQ contribute to Girls Who Code’s charitable initiatives based on a portion of EQUL’s management fee. Founded in 2012, GWC aims to support and increase the number of women in computer science by offering programs and clubs for girls, many of whom come from underrepresented groups. We’re proud to help Girls Who Code further its mission to inspire, educate, and equip girls with skills they need to become leaders.

How to Invest

How to Invest

Give the Gift of Dual Impact

When you invest in EQUL, or any of our IQ Dual Impact ETFs, you’re furthering our shared commitment to enhancing individual portfolios' potential and helping to advance the causes that matter to our lives and our planet. Most of all, IndexIQ is helping you align your investments with your values. Which means you’re empowered to do more today, for tomorrow.

The IQ Dual Impact ETF suite is available for purchase on all major trading platforms.

Invest in well-known stocks of companies that strive to combat the detrimental effects of heart disease.

Don’t have an account? Setting one up is easy – simply access your preferred platform and follow their instructions.

Give the Gift of EQUL

Did you know you can gift ETF shares through most brokerage platforms?

Visit your preferred brokerage platform’s website for specific instructions. You can also fill and print out the certificates below to give your recipient. Happy gifting!

Like other ETFs, EQUL is traded on a stock exchange and is available through brokerage firms.

You may click on any of the brokerage firms listed above to purchase EQUL. EQUL is also available through other brokerage firms. Before engaging any brokerage firm, you should evaluate the overall fees and charges of the firm that may apply, as well as the services provided. Ask your brokerage firm about any payment from New York Life Investments or NYLIFE Distributors LLC which may create a conflict of interest influencing the firm to recommend EQUL over another investment.

You will leave the New York Life Investments website by clicking any of the links above.

Foreign securities can be subject to greater risks than U.S. investments, including currency fluctuations, less liquid trading markets, greater price volatility, political and economic instability, less publicly available information, and changes in tax or currency laws or monetary policy. These risks are likely to be greater for emerging markets than in developed markets.

Large-Capitalization Companies Risk: Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large-capitalization companies has trailed the overall performance of the broader securities markets.

New Fund Risk: The Fund is a new fund. As a new fund, there can be no assurance that it will grow to or maintain an economically viable size, in which case it could ultimately liquidate.

Small and mid-cap stocks are often more volatile than large-cap stocks. Smaller companies generally face higher risks due to their limited product lines, markets and financial markets.

ESG Investing Style Risk Impact investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating. There is no assurance that employing ESG strategies will result in more favorable investment performance.

Gender Equality Investing Style Risk. The returns on a portfolio of securities that excludes companies that have not adopted the gender diversity and inclusion practices and policies may trail the returns on a portfolio of securities that includes companies that have not adopted these practices and policies. Investing only in a portfolio of securities that are gender diverse may affect the Fund’s exposure to certain types of investments and may adversely impact the Fund’s performance depending on whether such investments are in or out of favor in the market.

The Solactive Equileap U.S. Gender Equality Index is a quantitative and investable index developed by Solactive AG. It is a net total return index published in USD. A net total return index seeks to replicate the overall return from holding a portfolio consisting of the index constituents.

“IQ Engender Equality ETF (the “Fund”) is offered by IndexIQ, the Fund’s sponsor, in alignment with Girls Who Code Inc. (“GWC”). The Fund is designed to promote investment objectives that are deemed to be consistent with GWC’s mission. Shares of the Fund are not sponsored, endorsed or promoted by GWC, and GWC is not an investment adviser or service provider to the Fund. GWC makes no representations or warranties regarding the performance of the Fund and will have no obligation or liability in connection with the Fund. The Fund’s sponsor, IndexIQ, and its affiliates are supporters of and donors to GWC and are making a substantial contribution to GWC in connection with GWC’s agreement to license use of its name and trademarks to IndexIQ and its affiliates. NYLIM and IndexIQ’s contribution to GWC is calculated on an annualized basis to be the lower of: (i) 0.045% of the Fund’s average daily net managed assets (the average daily value of the total assets of the Fund, less all accrued liabilities of the Fund and less any management fees waived by the Fund’s adviser or sub-adviser); or (ii) ten percent of the Fund’s net annual management fee taking into account all applicable fee waivers and expense reimbursements. NYLIM and IndexIQ will make annual minimum contributions to GWC of $25,000 in each of the years 2021 to 2025 so long as their commercial co-venture is in effect.”

“New York Life Investment Management LLC (“NYLIM”) and IndexIQ Advisors LLC (“IndexIQ”) are donors to and supporters of Girls Who Code Inc. (”GWC”). GWC has authorized NYLIM and IndexIQ to reference its name and certain marks owned by GWC in connection with a commercial co-venture entered into between the Parties. None of the payments made by NYLIM and IndexIQ to GWC is in exchange for services provided by GWC."

STEM: Science, technology, engineering and mathematics

1. Girls Who Code. “Girls Who Code Annual Report 2020: Bravery in a Crisis.” Accessed 22 Sept. 2021 https://girlswhocode.com/2020report/?gclid=Cj0KCQjwkbuKBhDRARIsAALysV5Srok4Oicre8umSgPIbIeZInD7U4-dBWaqStSjPfBKp_GA0WpndfYaAju-EALw_wcB

2. STEM = Science, Technology, Engineering, Mathematics. Entrepreneur.com. “Infographic: The Tide Turns for Women in Tech.” Accessed 26 Sept. 2021. https://www.entrepreneur.com/article/289932

3. DuBow, W. & Gonzalez, J.J. (2020) NCWIT Scorecard: The Status of Women in Technology. Boulder, CO: NCWIT

4. Women in business and management: the business case for change / International Labour Office. - Geneva:ILO, 2019

5. International Labour Organization. “Women in Business and Management: The business case for change.” Accessed Sept. 2020. https://www.ilo.org/wcmsp5/groups/public/---dgreports/---dcomm/---publ/documents/publication/wcms_700953.pdf

6. Catalyst.org. Buying Power (Quick Take), “What is Buying Power?” Accessed Sept. 2020. https://www.catalyst.org/research/buying-power/